- Form 1099-NEC is used to report $600 or more in non-employee compensation paid to independent contractors in a tax year.

- Businesses issuing 1099 forms do not withhold taxes, making contractors responsible for income and self-employment tax payments.

- Payers must file and deliver Form 1099-NEC to both the contractor and the IRS by January 31.

- Independent contractors report 1099 income on Schedule C and calculate self-employment tax separately from W-2 employees.

The 1099 form is a series of tax-related documents in the US called "information returns" by the Internal Revenue Service (IRS). There are different types of 1099 forms for different payments you receive from a nonemployment income.

For example, an independent contractor 1099 form is issued to an independent contractor or a freelance worker who earns more than USD 600 nonemployment. This is also known as 1099-NEC and needs to be reported on the tax return.

Similarly, if you receive unemployment benefits, you’ll receive a 1099-G, which you need to report on your tax return.

A 1099 form for contractors includes a social security number or a taxpayer identification number to help the IRS know you have received money. So you can be identified easily if you have not reported the income on your tax return.

Different types of 1099 form

Depending on the source of the nonemployment income, there are different types of 1099 forms. Let's look at them one by one.

1099 form for independent contractors

Independent contractors or freelancers working with companies receive a 1099 NEC. Companies must send a 1099 NEC to all their contractors who worked for them but not as employees.

1099 MISC

As the form name suggests, any other nonemployment earning that doesn't fit the other 1099 form types should be filed under 1099 MISC.

1099 A

If your mortgage lender cancels some of your mortgages, you receive a 1099 A form because, according to the IRS, canceled debt is an income. The income is taxable, and you need to report it in your tax return.

1099 B

If you made an income from some sort of bartering via bartering exchange or from a sale of securities, you receive 1099B for the money you have received.

1099 C

If you have persuaded a credit card issuer to forgive your debt for less than you owe, it comes under 1099 C and needs to be reported in your tax return.

1099 CAP

If you are a shareholder in any corporation that had a capital structure change and you received money, stock, or other assets as a result, you may receive a 1099 CAP.

1099 DIV

This is the most common form of 1099. You receive a 1099 DIV when you earn dividends. However, money earned on your share account at the credit union comes under a different 1099 — 1099 INT.

1099 INT

Earning interest of more than USD 10 from a bank or any other financial institution will get you a Form 1099 INT.

A step-by-step guide to filling out the 1099 form

If you’re a US-based business and contracting work to independent contractors, you must provide them with an independent contractor 1099 form guide. Here’s a step-by-step guide containing all the information you need to know to fill out your first 1099 form for independent contractors.

Step 1: Identify your independent contractors

Before anything else, you need to know who are the independent contractors. Once you know them and know your books are in order, it’s time to complete the form.

💡Classify your employees and contractors correctly to avoid hefty penalties for misclassifying employees and independent contractors.

Step 2: Understand the 1099 form

In certain circumstances, an independent contractor 1099 form is not required. For example, if you have paid a corporation or a limited liability company, made business travel reimbursements to employees, and made payment towards storage, freight, and merchandise, a 1099 is not needed. Knowing these details will help you fill out the 1099 form correctly.

Step 3: Fill out the 1099 form

Get all the necessary documents ready before you start filling out the form. For example, you need a W-9 from your independent contractors before they provide any service.

Sections you need to fill:

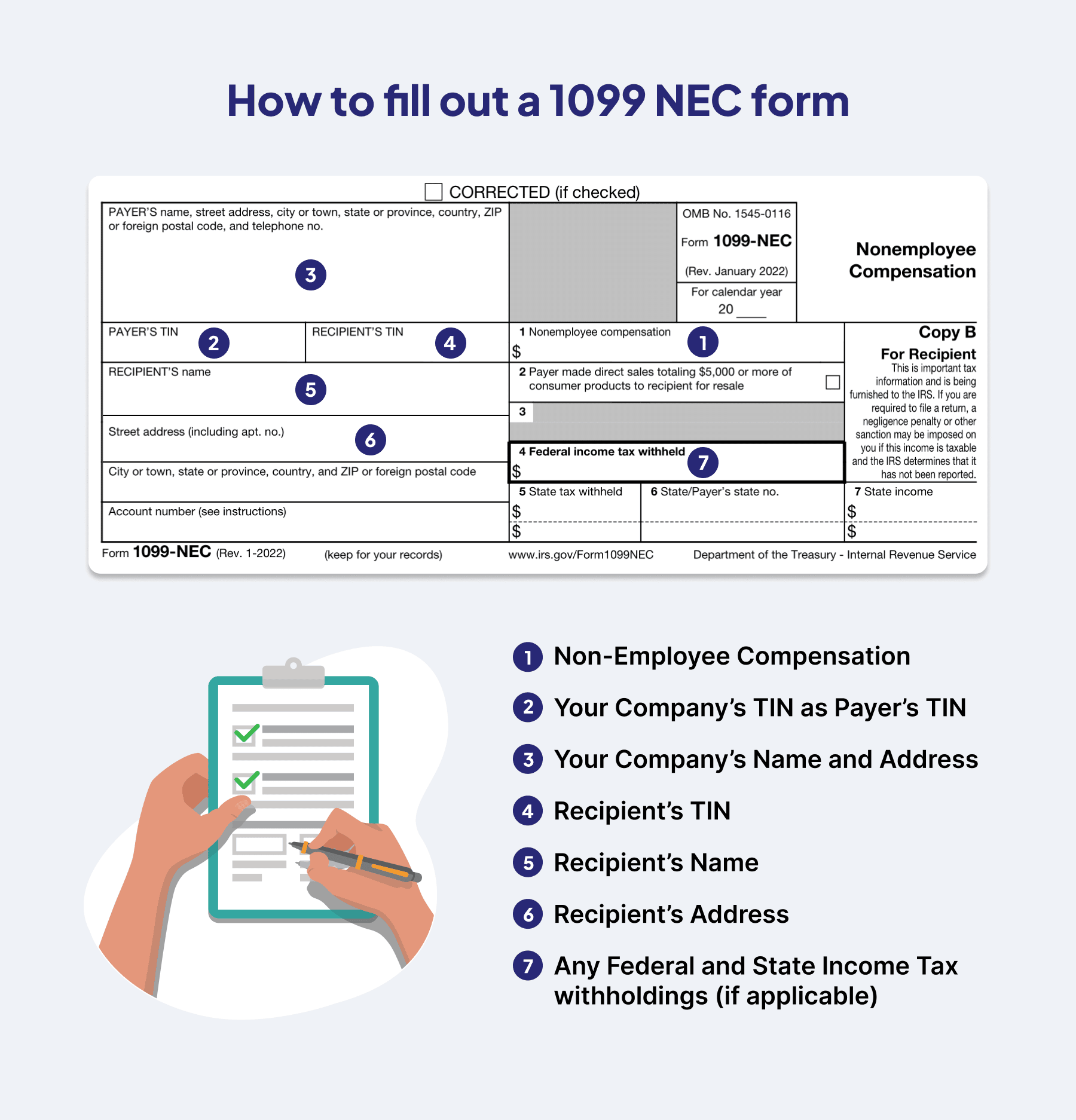

Instructions to fill out a 1099 NEC form

Nonemployee compensation

Fill in the details for nonemployee compensation paid.

Payers TIN

Share your company’s TIN or Tax Identification Number.

Payers information

Include your business’s name and address. Spell the details as per official records.

Recipient's TIN

In this field, include the Tax Identification Number of the contractor.

Recipients name

List the name of the independent contractor.

Street address

List the contractor's address.

Federal income tax withheld

List any federal income tax withheld, if any.

You’ll find a section to list the state income earned along with your company’s state TIN. While the IRS does not need these details, you might want to include them to make it easy for the contractor to state income tax filing.

Step 3: Submit the 1099 form

Once you have filled out the form, it’s time to provide the copies to various recipients.

- Copy A to IRS

- Copy B to the contractor

- Keep Copy C for your records

Note the due date

The due date for submitting the independent contractor form 1099 is 31st January every year. If the deadline (31st January) falls on a weekend or a holiday, the due date to complete the 1099 NEC is the next business day. So, you must provide the 1099 to the IRS and the contractor before the due date.

E-filing of 1099 makes it easy to meet the deadline. However, certain states require the business to file a 1099 with them, so check with your state before considering e-filing.

Penalties for missing 1099 NEC filing deadline

There are penalties for missing the 1099 NEC deadline for the contractor and the business. Missing a deadline may call for a penalty of USD 60 to USD 310, depending on how long it’s past the deadline. For intentionally disregarding a 1099 NEC, the penalty may be USD 630 or 10% of the income reported.

How to file 1099 online?

To e-file 1099, you’ll need:

- Employer Identification Number or EIN

- IRIS Transmitter Control Code (TCC)

- API client ID for A2A filers only

Any person or organization can e-file form 1099, including:

- Individuals

- Small businesses

- Third-party filers

- Software developers

- Large businesses

- Transmitters

- Tax-exempt organizations

Forms that you can e-file

Not all 1099 forms can be e-filed. The ones that can be done include:

- Form 1099-NEC, nonemployee compensation

- Form 1099-G, certain government payments

- Form 1099-H, health coverage tax credit (HCTC) advance payments

- Form 1099-INT, interest income

- Form 1099-K, card payment and Third-Party Network Transactions

- Form 1099-LS, reportable life insurance sale

- Form 1099-LTC, for long-term care and accelerated death benefits

- Form 1099-MISC, miscellaneous income

Find the complete list of 1099 forms that can be e-filed on the IRS site.

Things to remember while filling out the 1099 form

- Have a written copy of the contract with the vendor.

- Get the W-9 from your vendor before making the first payment to your 1099 vendor.

- If you have made payments for attorneys and medical corporations, it must be reported even if the amount is below USD 600

- W9s are confidential documents, and they must be secured to avoid identity theft.

- Conduct a quarterly 1099 report to ensure all information for the current year is updated on your accounting software.

Compliantly hire international contractors with Gloroots

If you’re in the growth phase and looking to onboard contractors compliantly, Gloroots is a global EOR that helps to get contractors on board ASAP.

Gloroots manages your payroll for international contractors, supports multi-currency payments and crypto pay-ins and payouts, enables compliant hiring and faster onboarding with automated contract generation, manages tax deductions for independent contractors, and maintains transparency with detailed monthly reports.

Interested to learn more about Gloroots?

Schedule a call today!